Quarterly Market Review & Outlook Q4 2025

2025 marked yet another strong year for global investors. Equities delivered a third consecutive year of double-digit returns, despite a sizeable correction early in the year that briefly pushed markets toward bear-market territory. After an extended period without a meaningful pullback, a reset of this kind was both understandable and arguably overdue. Importantly, it proved to be a recalibration of sentiment rather than something more fundamental as risk appetite stabilised, excess positioning cleared, and the market laid the groundwork for the next leg higher. The rebound that followed in April was distinctly V-shaped, and the remainder of the year was largely characterised by a steady push to new highs, supported by strong and broad-based earnings growth.

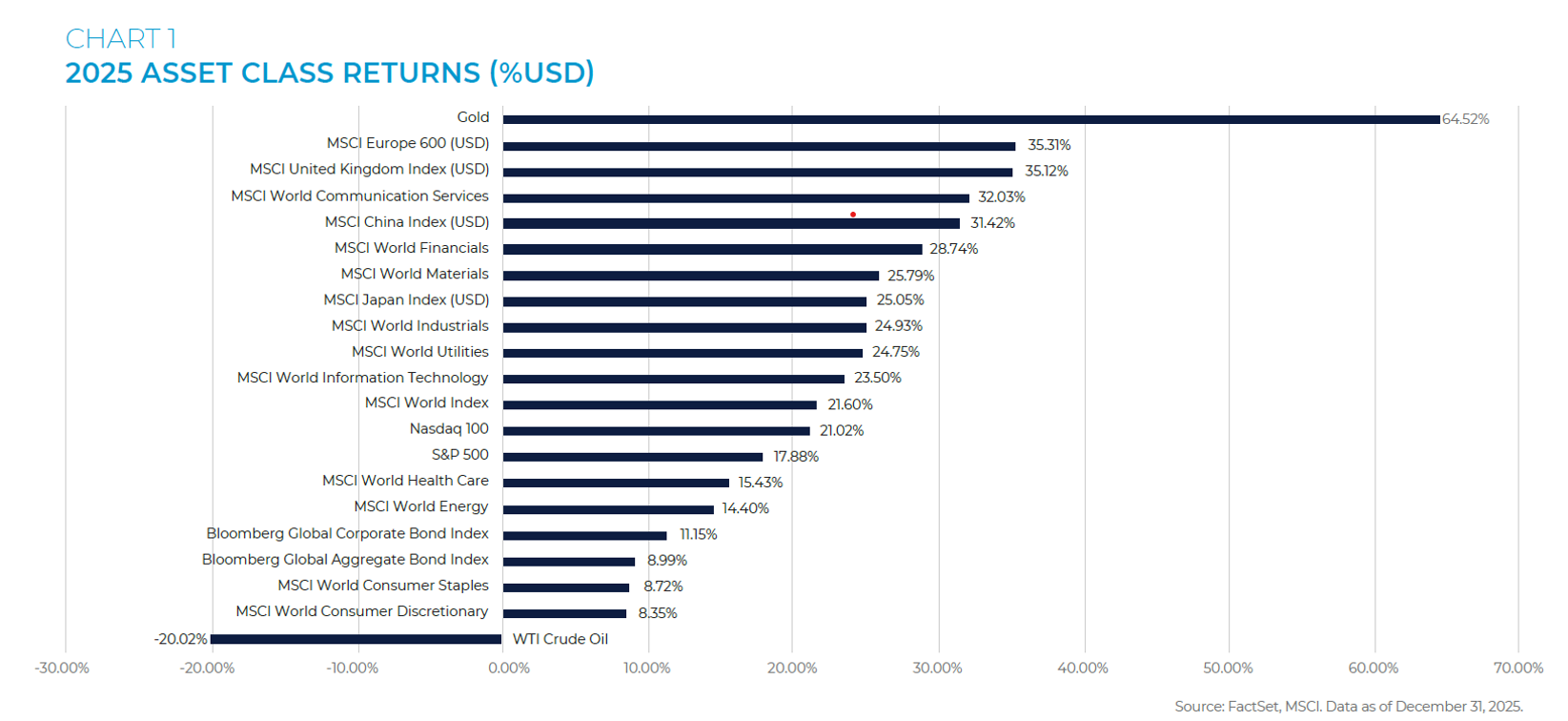

By year end, the MSCI World Index (USD) was up 21.6%, with global risk assets performing well overall as highlighted in Chart 1. Most major equity markets also posted strong gains in local currency terms, but for USD-based investors the currency backdrop added to their returns picture. With the US Dollar Index down ~10.2% year-to-date, foreign equity gains translated into more dollars when converted back, boosting the USD total return on international indices. However, it is worth emphasising that while FX can meaningfully influence returns over shorter horizons, over longer investment periods these effects tend to mean-revert, leaving underlying corporate fundamentals as the main drivers of returns.

Beneath the headline index returns, 2025 was defined by rotation and catch-up. Leadership broadened as the year progressed, supported by a steadier rate backdrop and earnings strength that extended beyond a narrow set of winners. This shift was visible both in sector dispersion and in the narrowing performance gap between market-cap indices and their equal-weighted counterparts, evidence that returns were less concentrated than in recent years.

Within our Q4 Market Review & Outlook, our Investment Committee provides a concise year-in-review of 2025, unpacking the key drivers behind returns across sectors and major asset classes. Looking ahead, the team sets out our 2026 outlook for steady growth and moderating inflation alongside a more measured easing cycle and outlines the core considerations and risks likely to shape markets over the coming year. The review concludes with a dedicated deep dive on the AI “bubble” debate, setting out the key indicators we monitor to assess whether excesses are building.

Click here to view the Q4 2025 Market Review & Outlook in full.

Please reach out via our contact us page should you wish to discuss or speak to one of our relationship managers or dedicated investment team.

Sigma Private Office operates under the trading name of Sigma Capital Partners MENA Limited. Sigma Capital Partners MENA Limited is regulated and authorised by the Dubai Financial Services Authority (DFSA) (F004667). Sigma Capital Partners MENA Limited’s registered address is Unit OT 18-32, Level 18, Central Park (Commercial) Tower, Dubai International Financial Centre, P.O. Box 507314, United Arab Emirates. Company number: 2843