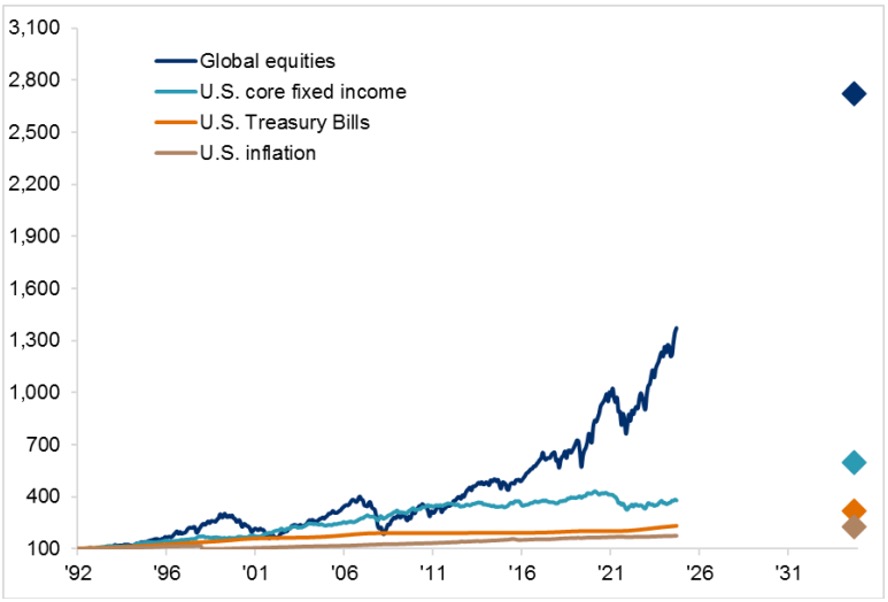

Chart of the Month: Why Equities are the Main Engine of Long-Term Capital Growth

Understanding how different asset classes work together is key to building a resilient portfolio. Each plays a role, from providing liquidity and stability, to driving long-term growth. Within this blog our Investment Committee share the key building blocks of growth within every portfolio, as well as our ‘Chart of the Month’ which showcases why equities remain central to wealth creation over time.

Chart of the Month

Below we highlight J.P. Morgan’s “Growth of $100” chart, showcasing the returns of various asset classes and inflation from 1991. The diamonds on the chart show the potential path forward for each asset class based on their Long-Term Capital Market Assumptions. This chart shows how equities and fixed income have historically outperformed cash and inflation over the long term.

Source: J.P. Morgan Asset Management, August 2025.

Every Asset Plays a Pivotal Role

Cash, bonds, equities, and alternatives each play a different role within a portfolio. When combined thoughtfully, they can help investors work towards their objectives, though the journey may involve periods of volatility along the way.

1. Equities – The Growth Engine

Do equities come with higher volatility? Yes.

However, they also provide the highest long-term returns. Driven by earnings and dividends, they remain the essential driver of capital appreciation over time.

2. Fixed Income – Stability and Income

Bonds play an important role in balancing portfolios. Over time, they should deliver higher returns than cash or inflation, with less volatility than equities. However, while they provide stability, the potential for meaningful capital appreciation is more limited.

3. Cash – Essential, but with Limits

Everyone needs a certain amount of cash for comfort and liquidity. Holding enough for everyday needs is important, yet keeping too much can hold back investment success and be costly as inflation erodes its real value over time.

4. Alternatives – Diversification Benefits

Private equity, real assets and hedge funds can enhance resilience and smooth volatility. Alternatives act as useful complements, but not as substitutes for equities.

Our Perspective: Why Do We Emphasise Equities?

At Sigma Private Office, we help our clients and their families to build resilient, long-term portfolios. With volatility being temporary and growth being enduring, equities are central to compounding wealth for the long-term.

Sigma Private Office operates under the trading name of Sigma Capital Partners MENA Limited. Sigma Capital Partners MENA Limited is regulated and authorised by the Dubai Financial Services Authority (DFSA) (F004667). Sigma Capital Partners MENA Limited’s registered address is Unit OT 18-32, Level 18, Central Park (Commercial) Tower, Dubai International Financial Centre, P.O. Box 507314, United Arab Emirates. Company number: 2843.