All-Time Highs – Justified or Complacent?

Global equity markets are once again trading at or near all-time highs. For many, that’s a cause for celebration but for some it can be a source of unease. The natural question arises: are markets being complacent, or are they simply reflecting resilient fundamentals?

A Rally Built on Earnings, Not Euphoria

The latest data shows that equities are indeed at historic highs, but not because investors are simply ignoring risks. On the contrary, markets have already adjusted to the weaker growth outlook having experienced a deep correction earlier in the year. Consensus GDP forecasts for late 2025 have been revised down by c. 1%, and earnings expectations were cut in parallel, suggesting equity markets have discounted a softer macroeconomic backdrop.

Since then, second-quarter earnings season has provided a clear anchor for recent gains. With nearly all S&P 500 companies now reported, 81% beat both earnings and revenue expectations, driving blended earnings growth of 11.9% year-on-year. This compares with just 4.8% earnings growth expected at the start of the quarter and marks the third consecutive period of double-digit growth.

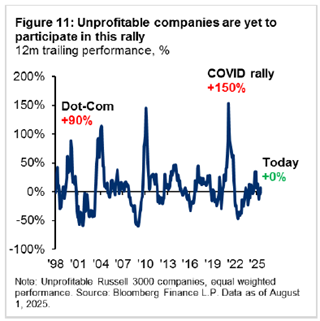

This combination of revised growth expectations and stronger realised earnings helps explain why markets are higher without signalling complacency. Furthermore, gains remain concentrated in profitable, large-cap firms with durable secular drivers, notably in technology and financials. While more cyclically exposed businesses have faced larger downward earnings revisions and unprofitable companies have failed to participate in the rally (Chart 1 – below). Options markets also continue to price above-average volatility, another indication that investors are not complacent.

Sentiment in Context

This aligns with something we’ve often highlighted at Sigma Private Office: the importance of recognising where we are in the sentiment lifecycle. In our article from Q3 2024 on sentiment lifecycle, we noted that sentiment moves in phases, from pessimism, to scepticism, to optimism, and finally to euphoria.

Today, the mood looks more like measured optimism than over-exuberance. Investors are allocating to risk assets, but in a selective manner, with fundamentals still driving outcomes and hedging activity visible beneath the surface. That is not the typical behaviour of markets in a euphoric state.

Staying Focused on the Long Term

It is tempting to assume that record highs mean the next move must be down. Yet history tells a different story. Contrary to common misbeliefs, returns are near identical when investing at all-time highs versus investing at any other time. Avoiding equities simply because markets are setting records is a reliable way to miss out on the compounding of long-term returns.

What matters for long-term investors is whether portfolios remain aligned with risk tolerance and financial objectives. Rather than attempting to time the market or react to short-term volatility, a disciplined strategy that harnesses the power of compounding is far more likely to succeed. In knowing this, you can look beyond immediate market conditions and focus on the long-term growth that has characterised equity investing over many decades.

Sigma Private Office operates under the trading name of Sigma Capital Partners MENA Limited. Sigma Capital Partners MENA Limited is regulated and authorised by the Dubai Financial Services Authority (DFSA) (F004667). Sigma Capital Partners MENA Limited’s registered address is Unit OT 18-32, Level 18, Central Park (Commercial) Tower, Dubai International Financial Centre, P.O. Box 507314, United Arab Emirates. Company number: 2843.