Earnings and Dividends: The True Foundations of Equity Returns

When considering the forces behind equity market returns, volatility, valuations and investor sentiment often dominate attention. Yet history clearly demonstrates that the true engines of long-term returns are in fact earnings growth and dividends.

Building on our recent Chart of the Month Why equities are the main engine of long-term capital growth, our Investment Committee explore how these two forces explain equities’ ability to generate sustained long-term wealth.

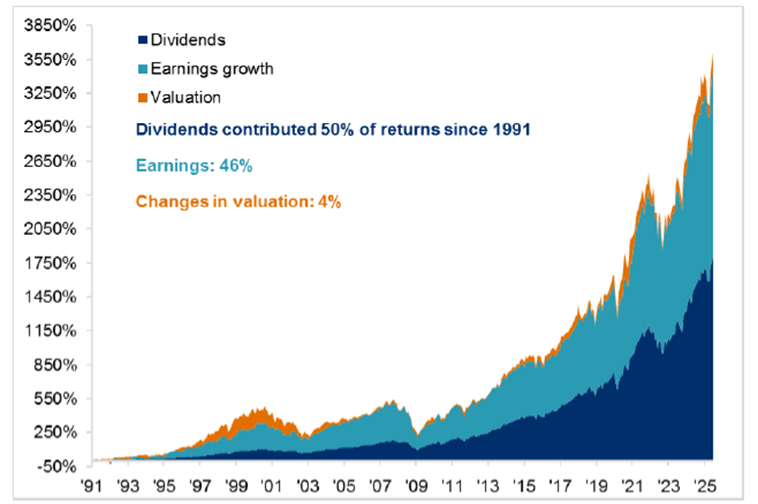

Chart 1: Over the long-run, equity returns are driven by earnings and dividends Contribution to cumulative total S&P 500 return since January 1991, %

Source: Bloomberg Finance L.P. Data as of July 31, 2025. References to J.P. Morgan Asset Management’s 2025 Long-Term Capital Market Assumptions are as of September 30, 2024.

Equities represent ownership in a company, giving each shareholder a claim on a portion of its profits. The value of that claim is ultimately driven by the business’s ability to grow revenues, increase profit margins, and generate cashflows for investment and distribution to shareholders. This explains why over time the cumulative total return of the S&P 500 has been overwhelmingly driven by earnings growth and the reinvestment of dividends (as shown in Chart 1). Valuation changes may dominate headlines in the short term, but their contribution to long-term returns has been far smaller by comparison.

The dominance and resilience of earnings and dividends is also no coincidence. Companies adapt to shifting economic landscapes, harnessing revolutionary technologies, entering new markets, and evolving their business models to meet changing consumer needs. In the 1990s, the internet completely changed how businesses operated. The early 2000s saw globalisation and supply chain integration drive efficiency and scale. More recently, cloud computing, mobile technology, and platform-based models have allowed companies to reach billions of customers directly. Today, artificial intelligence represents the next structural shift, with the potential to transform productivity, reshape industries, and create entirely new business models. These waves of innovation illustrate how earnings power is continually renewed over time.

Furthermore, the market itself also regenerates. While individual companies may falter, capital is consistently reallocated towards the most competitive and innovative firms. This dynamism ensures that, at an aggregate level, corporate earnings continue to rise. Dividends further amplify this process. When reinvested, they compound steadily in the background, turning incremental cashflows into a substantial driver of long-term wealth creation.

At Sigma Private Office, we have consistently highlighted the importance of these drivers and encouraged our clients to remain focused on the fundamentals. While valuations and sentiment will inevitably ebb and flow, the compounding effect of earnings and dividends has been the foundation of equity returns over time and will remain so in the years ahead.

Sigma Private Office operates under the trading name of Sigma Capital Partners MENA Limited. Sigma Capital Partners MENA Limited is regulated and authorised by the Dubai Financial Services Authority (DFSA) (F004667). Sigma Capital Partners MENA Limited’s registered address is Unit OT 18-32, Level 18, Central Park (Commercial) Tower, Dubai International Financial Centre, P.O. Box 507314, United Arab Emirates. Company number: 2843.