De-Dollarisation in Perspective: Shifting Sentiment, Not Structural Change

In early 2025, global investors have witnessed an uncommon convergence: US equities, Treasuries and the dollar have all moved lower at the same time. This combination is unusual and has prompted renewed discussion around the durability of the US dollar’s global role, raising questions about investor sentiment, macroeconomic confidence, and the broader state of the international monetary system.

While the term “de-dollarisation” has resurfaced in headlines, the facts point to a more measured reality. The dollar remains central to global trade, finance, and reserves; underpinned by the depth and liquidity of US capital markets and the institutional infrastructure that supports them.

The Context Behind Recent Dollar Moves

The dollar’s recent depreciation comes amid a backdrop of shifting sentiment. A combination of persistent US policy uncertainty, particularly around tariffs, and softening growth expectations has led to adjustments across asset classes.

Foreign inflows into US equities have paused after years of sustained buying and shifts in hedging behaviour among international investors have introduced further near-term pressure on the currency. These moves also reflect an increased appetite for regional diversification, with capital flowing towards Europe and parts of the emerging world.

However, these developments are best viewed as a portfolio rebalancing rather than a structural rejection of US assets. Demand for Treasuries, corporate bonds and US equities remains robust, supported by the global scale, transparency and liquidity of US capital markets.

What Is De-Dollarisation?

De-dollarisation refers to the gradual move by some countries to reduce their reliance on the US dollar for trade settlement, reserve holdings, or financial infrastructure. Motivated in part by geopolitical considerations, some central banks have increased gold allocations, and a growing number of bilateral trade agreements have been settled in local currencies.

As a result, the dollar’s share of global foreign exchange reserves has declined from over 70% in 2000 to around 58% in 2024, according to IMF COFER data*. However, these shifts have been incremental, not disruptive.

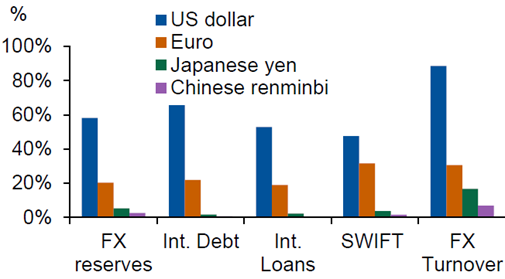

Despite headlines, the dollar remains the most widely used currency across key pillars of global finance:

Chart 1: The US dollar is still dominant in global trade and finance

Chart Source: JPMorgan. BIS, IMF, SWIFT, ECB. Data as of end 2022. FX turnover shares add to 200% as all transactions involve two currencies.

As shown above, the dollar still accounts for the largest share in global FX reserves, international debt, cross-border loans, SWIFT payments and FX turnover. These network effects are difficult to replicate and form the foundation of the dollar’s ongoing dominance.

Why Alternatives Fall Short for Now

Euro: Despite being the second-most used currency globally, the euro remains constrained by political fragmentation, lack of unified fiscal policy, and relatively shallow capital markets.

Chinese Renminbi: While China has expanded the renminbi’s role in bilateral trade and created its own payment systems (such as CIPS), capital controls, limited convertibility and legal opacity remain key barriers to reserve status.

Cryptocurrencies and CBDCs: Though growing in relevance, digital assets remain too volatile, unregulated and operationally immature to serve as global reserves or mediums of exchange at scale. Central bank digital currencies (CBDCs) are promising but still at the pilot stage, with limited cross-border integration.

The Dollar’s Role Remains Foundational

Despite periodic challenges, the structural role of the US dollar remains firmly intact. Its resilience is supported by:

- The depth and liquidity of US capital markets

- The size and openness of the US economy

- Rule-of-law governance and institutional continuity

- Self-reinforcing network effects that no rival currency currently replicates

While there may be a gradual increase in the use of alternative currencies for specific regional or political purposes, these do not equate to systemic change.

The recent repricing across US assets, including the dollar, reflects a normal shift in market sentiment after an extended period of outperformance. While some diversification is underway in global reserves and trade practices, this remains slow-moving and uneven.

Ultimately there is no realistic substitute for the dollar in global finance today. Shifts of this magnitude unfold over decades, not months or years. The current environment may signal a more multipolar currency landscape in the long term, but for now, the US dollar remains the cornerstone of the international financial system.

* Source: https://data.imf.org/en/Dashboards/COFER%20Dashboard

Sigma Private Office operates under the trading name of Sigma Capital Partners MENA Limited. Sigma Capital Partners MENA Limited is regulated and authorised by the Dubai Financial Services Authority (DFSA) (F004667). Sigma Capital Partners MENA Limited’s registered address is Unit OT 18-32, Level 18, Central Park (Commercial) Tower, Dubai International Financial Centre, P.O. Box 507314, United Arab Emirates. Company number: 2843.