Built to Last: Why Waiting for the “Perfect” Time to Invest Rarely Pays Off

With fresh tensions in the Middle East and global markets hovering near all-time highs, many investors naturally ask: Is now really the right time to invest new money in equities?

It’s a fair question, and one we hear often, especially when headlines feel unsettling and markets have rallied strongly. But history offers valuable perspective.

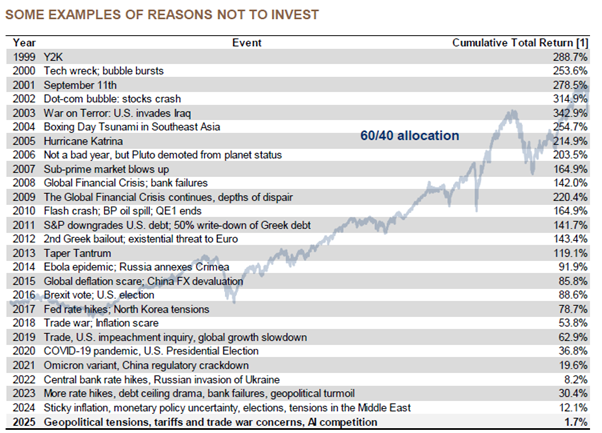

The JP Morgan chart below, “There is always something to worry about,” tracks a balanced 60/40 portfolio of global equities and bonds from 1999 to today. Over those 25 years, the world has seen market bubbles burst, terrorist attacks, global financial crises, a pandemic, wars and regional conflicts, yet through it all, investors who committed capital and stayed invested have been rewarded with resilient long-term returns.

Sources: J.P. Morgan, FactSet. [1] Cumulative total returns for the 60/40 portfolio (Net total return for MSCI World and Bloomberg Global Aggregate Bond Index) are calculated from December 31 of the year prior until the updated data. Data as of May 6, 2025.

Three reasons to invest despite the headlines

1. There is never a “perfect” moment, and waiting is often costly

Every year brings a new set of worries: the dotcom bust, the Global Financial Crisis, COVID-19, the Ukraine War, and now the recent developments in the Middle East, between Israel and Iran. Investors who tried to wait for clarity or a “better entry point” often found themselves paying higher prices later or missing entire recovery cycles.

At Sigma, we believe the most powerful advantage for investors is knowing it’s time in the market that matters, not timing the market.

2. Equities are necessary for long term capital appreciation

While markets are near record levels, the reality is that earnings growth, the ultimate driver of long-term equity returns, remains robust. Companies continue to deliver healthy profit growth and reinvest for the future, supporting valuations. When compared with holding cash or fixed income, equities continue to be the main driver of capital appreciation over time. This has been true historically, and we see no reason for that to change.

3. Geopolitical shocks usually matter less than feared

Regional conflicts create uncertainty and can unsettle markets in the short term, but rarely have they had the scale to cause bear markets. Oil prices may tick higher, central banks may adjust, and headlines will swirl. But history shows that diversified portfolios have weathered far more major shocks without derailing the long-term upward trend in returns.

How we help clients deploy new capital today

For investors looking to put new money to work, our approach is simple:

- Diversification: We maintain a balanced mix of quality global equities and fixed income to dampen volatility.

- Active oversight: Our Investment Committee continuously monitors global developments, adjusting positioning as needed to capture opportunities and manage risk responsibly.

- Long-term mindset: Above all, we remain focused on what truly builds wealth: disciplined, patient investing through cycles. The Importance of a Long‑Term Mindset When Investing, is one of our core principles.

Every market high brings a wave of “what ifs”. Today’s environment is no different, but if you’re waiting for the perfect moment to invest, you may be waiting forever. This article stands as a timely reminder to us all that despite wars, crises and recessions, those who deploy capital thoughtfully and remain invested have historically come out ahead, as markets reward patience more than anything else.

If you’d like to discuss how best to put new or additional funds to work in today’s environment, get in touch and our team would be happy to arrange an initial consultation call.

Sigma Private Office operates under the trading name of Sigma Capital Partners MENA Limited. Sigma Capital Partners MENA Limited is regulated and authorised by the Dubai Financial Services Authority (DFSA) (F004667). Sigma Capital Partners MENA Limited’s registered address is Unit OT 18-32, Level 18, Central Park (Commercial) Tower, Dubai International Financial Centre, P.O. Box 507314, United Arab Emirates. Company number: 2843.